Particle Swamp Optimization (PSO): Does Wisdom of the Crowd work in Investing?

Particle Swarm Optimization (PSO) is a computational method inspired by the way groups of animals, like birds or fish, move together in search of food. If you see a swarm of drones doing a light display or videos of wild geese flying in formation, or a school of fish moving as one superorganism when alarmed that’s PSO. In other words, PSO embodies the old adage of “Wisdom of the Crowd.

In finance, PSO is used to find the best mix of investments by simulating a "swarm" of possible portfolios, each adjusting its mix based on both its own experience and the experience of others in the swarm. PSO and the “wisdom of the crowd” in Finance is not unlike the real-life practice of following the crowd, listening to rumours and over-reaction to extreme changes in the market environment.

Does Wisdom of the Crowd work in Investing?

In this project, the swarm was made up of individual investors. The buy sell rules and prices were decided by the majority and investors adjusted their investing decisions by following the herd. The primary rule was to minimize risk/return i.e. to maximize the Sharpe Ratio, with the constraint that all the weights must add up to 100%. There were no limits on how much could be allocated to each stock, so the optimizer sometimes put very large weights on a few stocks and ignored others.

Results (Based on holding a portfolio from 2 Jan 2024 to 4 July 2025)

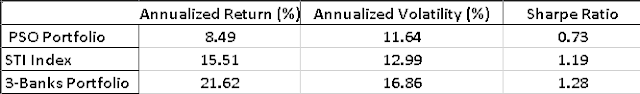

- PSO portfolio has an annualized return of 8.49% with a volatility of 11.64% and a Sharpe ratio of 0.73.

- The STI Index delivers a higher annualized return of 15.51% with a volatility of 12.99% and a Sharpe ratio of 1.19.

- The 3-bank portfolio outperforms both, with a 21.62% annualized return, 16.86% volatility, and the highest Sharpe ratio of 1.28.

Comments

Post a Comment