Trump's Trade Tariffs: Which Countries will be most impacted?

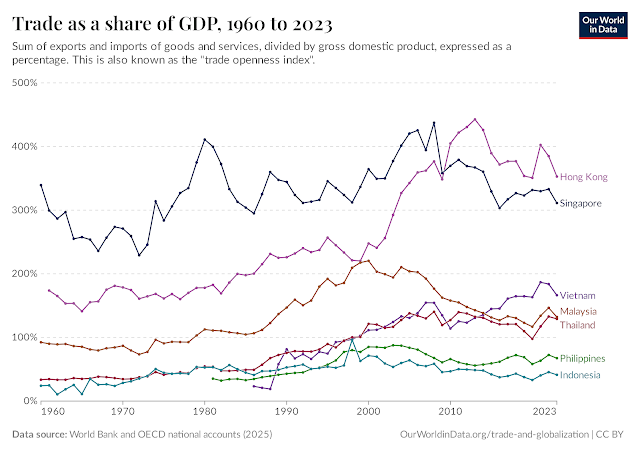

The two charts above only tell the story up to 2023 from the Tariffs imposed during Trump's first term together with those imposed by the Biden administration. And we have to wait till 1 August to see what Trump does-- TACO out again, or follow through on what he said, or make some adjustments. So far, as of today, the UK, Vietnam and Indonesia have 'caved in' to avoid the punishing Tariffs on them announced by Trump. Japan is particularly vulnerable due to its exports of automobiles, steel and machinery to the USA but is holding up strong to Trump. Germany's very high Trade/GDP ratio at first sight seems to suggest its very vulnerable. But it is part of the EU and has some relief and exemptions from trade Agreements negotiated between USA and EU. I am not sure why Indonesia bowed to Trump. Its Trade/GDP ratio is very low. Unless its all about Palm Oil which has a large market in the US , also President Prabowo is streetsmart and wily and knows to to pander to Trump's egoisim and susceptibility to flatttering, and maybe there's a strategy behind this as in Indonesian Wayang Kulit (Javanese puppet shadow performance). Hong Kong and Singapore have very high Trade/GDP ratios but being global financial hubs, exports of high-value Services make up a significant portion of their Trade and so they are less vulnerable. I wouldn't worry about China- it has a huge resilient economy and has always been able to adapt quickly to any challenges. Its Trade/GDP ratio has been going down and will continue to go down as it pivots to an economy led by domestic consumption. Meanwhile its manufacturers have opened up many new markets (Latin America, Australia, Africa, Central Asia) as can be seen by the increase in exports for April (6.3%), May (4.8%) and June (5.8%) 2025 despite the threats from Washington.

Whatever Trump does is futile. We all want China's innovative, affordable and high quality goods. Compare that with expensive, mediocre goods from the USA-in an age when establised Western brandn names no longer has the same appeal any more in Asia and the BRICs countries.

Comments

Post a Comment